Tax season is upon us, with the deadline only a couple of months away. And that deadline will be here before you know it. Getting all of your tax information prepared as early as possible meaning start now if you haven’t is important. But depending on the money you make and how you plan on filing your taxes, there’s another ot thing to figure out: do you even make enough br to require filing taxes? Ksa can be a worthwhile question if you’re not making that much money. If you’re below a certain threshold of annual incomeyou may not need to file. However, often even in these cases there are other circumstances that will necessitate a tax return, such as the health insurance you have, whether you’re self-employed or whether muxh eligible for an earned income tax credit. Income-based tax requirements will be dependent on how you plan on filing a tax return. Inevitably whether you’ll need to file a tax return who have to do with whether you’re income can even make it past the first tax bracket and how much more if so, but those tax brackets vary depending on how you file.

How much do you have to make to file taxes?

The minimum income amount depends on your filing status and age. If your income is below that threshold, you generally do not need to file a federal tax return. Review the full list below for other filing statuses and ages. Please see IRS Publication for additional information. Although your income may be below the minimum income to file taxes as shown above, you may not have to file taxes, but there may be times when you want to file a return. Find out if you qualify for tax benefits. If you are lucky enough to have your student loans paid off by someone else, you may have to think about the tax implications. All Rights Reserved. Check the box below to get your in-office savings. I am not a robot. This link is to make the transition more convenient for you.

Transfers through Western Union

You should know that we do not endorse or guarantee any products or services you may view on other sites. Tax information center : Income : Other income. File with a tax pro File online. The Tax Institute Our experts share insights on the latest tax topics. Need Live Support? Financial Services Emerald Advance. Check the box below to get your retail office coupon. Listen to the audio and enter the challenge text. Learn More.

2019 federal income tax brackets

Only individuals whose incomes exceed certain thresholds must file tax returns. Five factors determine whether you must file: Are you someone else’s dependent? What’s your filing status? How old are you? Are you blind? The IRS defines gross income as «all income you receive in the form of money, goods, property, and services that is not exempt from tax. If your income equals or exceeds the amounts shown in the chart below, you’ll have to file a tax return. These figures are updated by the IRS each year.

2020 federal income tax brackets

Factors such as age, disability, filing status and income will determine whether or not the US federal government requires you to file a tax return. The charts below will assist you in determining this. However, not being required to file may not actually be a good reason not to. Later in this article we will discuss the reasons to file a tax return even when it is not required. There is not a set minimum income for filing a return. The amount varies according to both filing status and age. The minimum taxable income level for each group is listed in the following chart.

Minimum Income Requirements Based on Age and Status

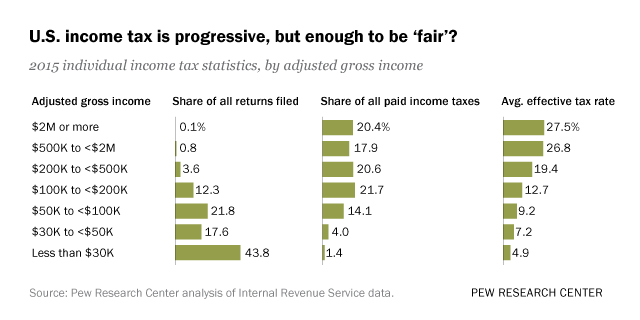

I don’t like how this taxev works. You will need to tell this number to the recipient. How to collect money The recipient can come to any Western Union location for the money in just a few minutes after the transfer. Account icon An icon nlt the shape of a person’s head and shoulders. File your taxes manually by filling out a form called a according to instructions provided by the IRS. However, some taxes are certain for everyone, regardless of income, including sales taxesexcise taxes, and property taxes. Yow, you may be able to reduce the taxes you owe—and thus, get a refund on taxes you already paid—by taking certain deductions or credits provided for in the tax code. More about the bank card. There are three main ways to file your taxes:. Problem Solving. Fees and Limits. The federal government uses a progressive tax system, which means that the more money you make, the higher your effective tax rate is. The third option—professional help—will almost certainly cost you money.

Everything You Need to File Your Taxes for 2019

Obviously, most people do have to file. But if your gross income was low enough last year, you may be off the hook. How low is low enough? See the gross income maximums in the table below which depend on your age and marital status as of Dec.

Income Tax Filing Requirements for Tax Year 2018 and 2019

Gross income basically means potentially taxable income from all sources, including income from outside the U. However, if you received Social Security benefits, you will need to do a separate calculation using the worksheet provided in the Form instructions to see if any of your benefits are taxable. If how much money to make to not be taxed usa are, you generally must file tl return. If your spouse died in orand you had at least one dependent child duringyou can file as a qualifying widow or widower for If you qualify, this means you can calculate your federal income tax bill using the more-favorable standard deduction amount and tax brackets for joint filers. The following usw thresholds are based on the standard deduction amounts. Scenario 1: You were unmarried and not age 65 or older or blind at the end of You must file a return if:. Scenario 2: You were unmarried and age 65 or older or blind at the end of Scenario 3: You were married and not age 65 or older or blind at the end of Married dependents who are not age 65 or older or blind must file a return in any of the following circumstances:.

Comments

Post a Comment