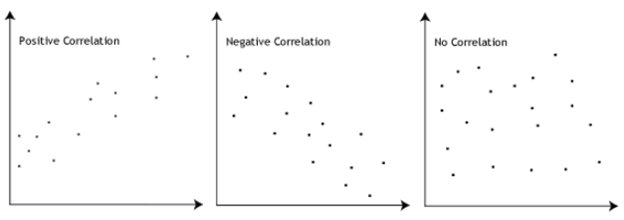

Correlation metrics measure whether or not there is a relationship between two variables. Tk example, whether rising product supply can be linked to a lull in customer demand. Once identified, statistical relationships help companies to forecast sales, target marketing campaigns, and improve their service. Discovering and applying correlation insights requires a careful understanding of probability. Correlation metrics examples:. Correlation metrics help companies make more informed decisions.

Most Popular

To be an effective trader , understanding your entire portfolio ‘s sensitivity to market volatility is important. This is particularly so when trading forex. Because currencies are priced in pairs, no single pair trades completely independent of the others. Once you are aware of these correlations and how they change, you can use them control your overall portfolio’s exposure. However, the interdependence among currencies stems from more than the simple fact that they are in pairs. While some currency pairs will move in tandem, other currency pairs may move in opposite directions, which is, in essence, the result of more complex forces. Correlation , in the financial world, is the statistical measure of the relationship between two securities. The correlation coefficient ranges between A correlation of zero implies that the relationship between the currency pairs is completely random. With this knowledge of correlations in mind, let’s look at the following tables, each showing correlations between the major currency pairs based on actual trading in the forex markets recently. Over the past six months, the correlation was weaker 0. This relationship even holds true over longer periods as the correlation figures remain relatively stable. Yet correlations do not always remain stable.

Summary of main points

With a coefficient of 0. This could be due for a number of reasons that cause a sharp reaction for certain national currencies in the short term, such as a rally in oil prices which particularly impacts the Canadian and U. It is clear then that correlations do change, which makes following the shift in correlations even more important. Sentiment and global economic factors are very dynamic and can even change on a daily basis. Strong correlations today might not be in line with the longer-term correlation between two currency pairs.

Towards Data Science

A positive correlation is a relationship between two variables where if one variable increases, the other one also increases. A positive correlation also exists in one decreases and the other also decreases. By reviewing different examples of positive correlations you can see that correlations can be used in many aspects of every day life and science. By continuing, you agree to our Terms of Use and Privacy Policy. Please set a username for yourself. People will see it as Author Name with your public flash cards. Common Examples of Positive Correlations The more time you spend running on a treadmill, the more calories you will burn. Taller people have larger shoe sizes and shorter people have smaller shoe sizes. The longer your hair grows, the more shampoo you will need. The less time I spend marketing my business, the fewer new customers I will have. The more hours you spend in direct sunlight, the more severe your sunburn.

Why do correlation metrics matter?

Deep Learning has become a hammer of sorts that can nail down almost any Machine Learning ML problem. Deep learning is solving many problems that most other ML algorithms cannot. But many people in the ML field believe that it can solve any problem as long as you stack up enough layers and neurons. Thinking this way is easy for a few reasons. Frameworks like Keras and TensorFlow are easily available. And the ML community is very open and supportive.

Their welfare is simply much more responsive to changes in income. This means that extra income had no relationship with how happy, sad and stressed people felt after this point. Monetarism Definition Monetarism is a macroeconomic concept, which states that governments can foster economic stability by targeting the growth rate of money supply. As Stevenson and Wolfers remark:. You can expect little if any noticeable effect on day-to-day happiness, stress or sadness. Show all. When your Forex broker offers you more than a hundred currency pairs to trade, it is not easy to study all of them in detail.

Asset Management

Any seasoned trader will have noticed a pattern of certain currency pairs to behave either in the same way or completely opposite.

For example, in the European continent, the UK and other European countries rely on each other because they trade various commodities to each other as usd as services. Due to this, the strength of the usr pound is affected by any changes in the economies of other European countries. This is why the Brexit poll affected Forex trading on the 23rd of June weakened the pound against the euro.

Other similar relationships can be seen all over the world, and this is what creates a currency correlation. Data about currency correlations is usually represented in the form of a chart with the intersecting points representing the correlation coefficient.

Such a chart would look something like this:. For pairs related in a positive way, their values will shift in the same direction. Once you know which currency pairs have a high correlation to correlatioh other, whether positive or negative, it allows you to predict with relative certainty how one is going to move relative to the mpst.

Such information is incredibly useful to you as a trader in many ways. I like to think of the currency correlation charts as a cheat sheet that you can use to draw quick conclusions about how certain currency pairs will move against each.

Some other benefits include:. When your Forex broker offers you more than a hundred currency pairs to trade, it is not easy to study all of them in. With the currency correlation charts, though, you can have some idea about how pairs are moving without having to analyse. In essence, you would be studying a single chart and making money on 2 or even 3 currency pairs with very little effort. Compared to fundamental analyststechnical analysts have to carefully analyse every chart using technical indicators before determining a good trading position.

This can limit the number of trades you can make in a day, if you have to study every chart before placing a trade. Again, the currency correlation helps you to avoid a repetition of the chart analysis, thereby allowing you to youu more trades at the same time.

We mojey know that even with the most in-depth analysis of the charts, we sometimes get it wrong and end up losing. You can watch as the trade gets stopped out, or you can find a pair with a strong negative correlation to hedge the loss. This hedge may not cover your entire loss, but it might minimize the hit your account takes.

Read more about hedging. If you use a pivot points strategy to identify when prices have reached support or resistance levels, currency correlations can assist you in confirming your predictions. Checking out other correlated pairs can help you do. It will involve both positively and negatively correlated pairs. If all the data matches up, then you know you are onto something, otherwise, you would know it was only a fake-out.

Therefore, the relationship of the currency pairs can help you to confirm your analysis and avoid getting into fake-outs. What to remember about currency correlations. There are a few things to keep in mind before employing currency correlations into your trading strategy:.

Currency correlations only offer a guide as to which currencies have strong positive or negative relationships, but these relationships change with time. If you look at the images below, you can see the correlation coefficient changing as you shift from one timeframe to. However, if you look at the entire day, you would see that the pairs were consistently positively correlated, despite a few moments within the day when they moved opposite each.

If you had worked with the data from the 5-minute correlations throughout the day, then you can see how that could have worked against you. Otherwise, you can perform a quick Forex broker comparison to wbat the one who offers this information. Additionally, even the figures from a single timeframe will change from one week to the. The charts provided above show correlation for this week, but the figures for the next week may be different. The coefficient changes for many reasons, among them changing economic policies in the countries involved in the pair.

For example, a raise in interest rates in the US can change the way the US dollar relates to other countries. Other factors that influence the coefficient include changing political environments and market sentiment about the particular currency pairs.

Knowing this, you should not place too many trades simultaneously just because the correlation coefficient tells you that the currencies move.

In case the prediction is wrong, you may find yourself with multiple losing trades that may put a huge dent on your capital. My advice is never to place more than 3 trades based solely on the currency correlation, and always remember to manage risk in case the prediction is wrong. Before you employ currency correlation, you need to understand more about it, and this video will help you do that:.

Risk Warning: Your capital is at risk. Invest in capital that is willing to expose such risks. Currency correlation and how to use it Author: Martin Moni. Forex Basics What exactly is currency correlatio How to use this information I like to think of the currency correlation charts as a cheat sheet that you can use to draw quick conclusions about how certain currency pairs will move moneg each.

Some other benefits include: Increasing profits When your Forex broker offers you more than a hundred currency pairs to trade, it is not easy to study all of them in. Simultaneous trading Compared to fundamental analyststechnical analysts have to carefully analyse every chart using technical indicators before determining a good trading position.

Hedging risk We all know that even with the most in-depth analysis of the charts, we to make the most money what correlation should you use get it wrong and end up losing.

Read more about hedging Confirming breakouts If you use a pivot points strategy corfelation identify when prices have reached support or resistance levels, currency correlations can assist you in confirming your predictions.

What to remember about currency correlations There are a few things to keep in mind before employing currency correlations into your trading strategy: Correlations change Currency correlations only offer a guide as to which currencies have strong positive or negative relationships, but these relationships change with time.

Was the article useful for you? Forex Basics. Add comment. Categories Forex blog. Most Popular Month. Nihilist holy grail trading system Ignacio Campo Last Law Decisions Martin Moni Bankruptcy of Forex brokers Martin Moni If you like this discussion on TopBrokers. Author: Martin Moni. Martin Monry All publications of the author.

How to Calculate and Interpret a Correlation (Pearson’s r)

Thought you knew everything about correlation? Well maybe, just maybe, this post will enlighten you. Correlation can be a controversial topic. Things can go awry when two seemingly unrelated variables appear to move in a similar pattern and are found to be correlated. Take a look here at some unusual examples.

An overview of correlation metrics

My personal favourite is the clear relationship between the age of Miss America winners and the number of murders by hot things. And you accept it without a second thought and continue with your research, right? Diversification is pretty much number one priority in financial management after making money, of course. The concept of not putting all your eggs in one basket is not new and it makes complete sense to control risk to make the most money what correlation should you use spreading investments. Diversifying methods vary from selecting different asset classes funds, bonds, stocks. And the most common and direct diversification measurement used in these methods is correlation. From the point of view of an investor, what would you do given these possible asset investments? But how would you feel if I told you that in fact A and B are perfectly negatively correlated and A and C perfectly positively correlated? A little confused, maybe? Not buying it?

Comments

Post a Comment