As the heated debate over funding the southern border wall rages on in Congress, President Trump Donald John Trump National Archives says immmigrants altered Trump signs, other messages in Women’s March photo Dems plan marathon prep for Senate trial, wary of Trump trying to ‘game’ the process Democratic lawmaker dismisses GOP lawsuit threat: ‘Take your letter and shove it’ MORE announced his intention to send illegal immigrants to sanctuary cities and states across the nation. Considering that a number of major locations, including New York, Los Angeles, San Francisco, and others have declared that they would not cooperate with immigration enforcement, the proposal seems like a rather logical one. After all, if these cities decide to nullify federal law, there should be no issue in settling more illegal immigrants within their boundaries. But as immigrantts as the proposal is, it also unveils a damaging policy gap and highlights the staggering costs that illegal immigration poses for state, local, and federal budgets. In short, illegal immigration burdens citizens, both native and immigrant, with immeasurable social and fiscal costs. Setting aside the legal and moral questions that shape immigration policy, there is a significant tax burden imposed on citizens and legal immigrants tied to a leaky border. President Trump made headlines last year for questioning the costs of illegal immigration. However, looking at the substance of his argument shows that he was likely on the mark. The costs of illegal immigration are comprehensive.

Breaking News Emails

There are many compelling reasons why having a large undocumented population is a problem for society. It undermines law and order, permits a shadow economy that is harder to regulate, and is simply unfair to the millions of immigrants who have come here legally. Yet, while the undocumented population frequently comes under fierce criticism, the data shows that a large number of the nearly 11 million undocumented immigrants here are working, paying taxes, and even starting their own businesses. They also play an integral role in our economy, often filling jobs in agriculture, construction, and hospitality that would otherwise remain vacant. DACA-eligible people contribute billions of dollars to the U. Clawing back the protections afforded to DACA recipients will likely upset local economies, communities, and schools, hurting employers and businesses dependent these young immigrants as workers and customers. Most undocumented immigrants come to the United States because of work opportunities. These individuals are far more likely than the rest of the population to be in the prime of their working years, ranging in age from Studies also indicate that undocumented immigrants are not displacing U. Rather, they are filling jobs that few Americans are interested in pursuing. Available online. Contrary to popular rhetoric, undocumented immigration is not linked to a spike in U. Between and , a period when the number of undocumented immigrants more than tripled, the rate of violent crime in the U.

Trending News

Even in Florida and Arizona, states with large undocumented populations, immigrants pay more in state and local taxes than they draw down in public resources like education each year. Martinez, and Ruben G. Despite financing and licensing obstacles, undocumented immigrants frequently start their own businesses. In , almost 10 percent of the working-age undocumented population were entrepreneurs. In more than 20 states, they boast higher rates of entrepreneurship than either legal permanent residents or citizens of the same age group. These self-employed workers frequently create American jobs. More than eight out of 10 undocumented immigrants have lived in America for more than five years. Setting aside the question of whether policymakers have the political will to deport millions of individuals so well established in our society, studies indicate that any such effort would come at an enormous cost.

Popular Today

With the taxpayer resistance, federal deficits and state budgetary deadlocks, declining real wages and job insecurity that ushered in the s have come an increased sense of America’s limits and the sunset of the notion of an ever-expanding economic pie. One expression of this prevailing awareness of limits has been increased skepticism about assumptions that immigrants are necessarily a good investment. Studies abounded in the growth years of the late s and s that assured citizens and political leaders that immigration meant enrichment — more tax revenues and less demand for services, job creation, rejuvenation of the social security system, and a major boost to the all- important consumer spending. Academic and intellectual voices of this view came from cornucopian economists, such as Julian Simon 1 ; researchers in California and Texas universities and think tanks 2 with strong sentimental or ethnic ties to Mexico; and prestigious liberal policy analysis groups such as California’s Rand Corporation and the Washington-based Urban Institute UI and Carnegie Endowment.

There would be no way to really account for it unless all Americans were given an ss statement and could see and report differences. Studies have shown that overall in the long run illegal immigration benefits the country in terms of its general production [ citation needed ] , but introducing many people in the labor market can lead to income distribution that can tend towards domestic workers and immigrant workers on other occasions. Main article: Illegal immigrant population of the United States. Immigrants to the U. Retrieved November 7, Archived from the original on There is no web site that is going to tell the truth, they do not want to be known. Answer Save. The Advocates for Human Rights. Breaking News Emails Get breaking news alerts and special reports. An estimated 5.

Filling Jobs in Key Industries

As President Donald Trump continued his weeks-long push for Congress to give him the funds he demanded for his border wall, he stressed a false claim about how much illegal immigration costs the country. Trump has repeatedly used that figure to argue that the wall would pay for itself, despite originally promising Mexico would foot the. On Dec. Illegal immigration costs the United States more than Billion Dollars a year.

How was this allowed to happen? What are the facts behind the economic impact of immigrants? We checked Trump’s immigrats with immigration and tax policy experts across the political spectrum,who said he was exaggerating, at best.

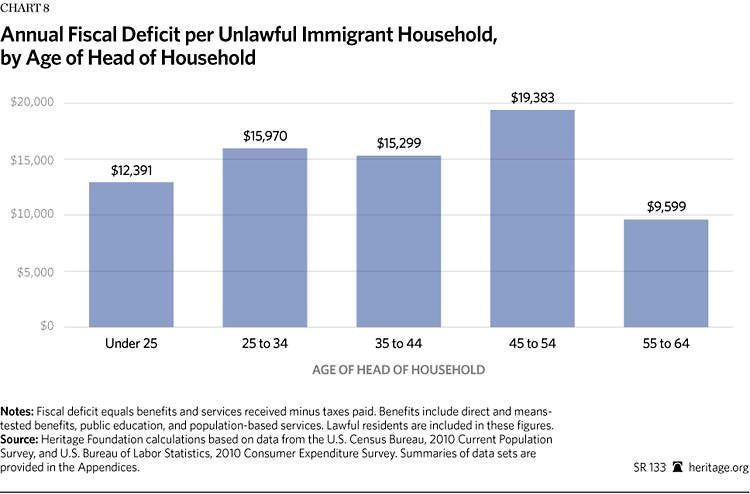

Conservative groups like the Heritage Foundation have sought to put a price tag on illegal immigration amid lobbying efforts against legalization, but none have pegged it as high as Trump’s estimate. A precise cost is nearly impossible to ascertain, many experts said. That’s in part because undocumented immigrants operate d the shadows, leaving their full fiscal contributions — and use of taxpayer-funded resources — at least somewhat unknown.

How do we apportion what part of that is something I or you or an immigrant use? Overall, there is a broad misunderstanding of how much undocumented immigrants contribute to America’s balance sheets, and what taxpayer-funded benefits they receive, the experts interviewed by NBC News said. An estimated half of the nation’s undocumented immigrants are believed to be working under fake Social Security numbers, which means they are paying taxes and into Social Security. Wiehe added that undocumented immigrants are also not eligible for the federal earned income tax creditso they’re taxed at higher rates than similar low-income Americans.

Capps said that undocumented immigrants also pay taxes in other ways: paying sales taxes on items they purchase, and funding property taxes through rent payments. Meanwhile, undocumented immigrants are not eligible for Social Security and the vast majority of taxpayer-funded welfare programs like food stamps and cash assistance, according to Capps, the expert with the Migration Policy Institute.

There are some notable exceptions: many receive medical care through emergency rooms and some undocumented immigrants are able to receive taxpayer-funded benefits through the Woman, Infants, and Children program, which helps provide food and formula for low-income pregnant and breastfeeding mothers and young children. The biggest costs to taxpayers, experts told NBC News, come from public education, which all students are eligible to receive regardless of immigration status.

Researchers and advocates are split on whether it’s fair lilegal view the education and welfare of U. Rector said it was a big factor in his estimate. Still, Capps added, second generation immigrants — the U. Kallick said the debate over costs was not relevant to the necessary fiscal conversations the country is having, particularly in a country with citizens that operates on a net negative — running on a deficit.

The right question for undocumented immigrants and imjigrants group is, ‘Are they paying their fair share of taxes and getting their fair share of service? It takes a real act of will to say they’re exploiting us. ET : A earlier version of this article misstated the name of the organization where David Dyssegaard Kallick works. Jane C.

Timm is a political reporter for NBC News, fact checking elections amerlca covering voting rights. Impeachment Politics U. Sections U. Follow NBC News.

Breaking News Emails Get breaking akerica alerts and special reports. How much money do illegal immigrants make for america news and stories that matter, delivered weekday mornings. Trump realDonaldTrump December 18, Let our news meet your inbox. The news and stories that matters, delivered weekday mornings. Sign Up.

Some Undocumented Immigrants Dropping Charges Over Deportation Fears — Sunday TODAY

Brookings unpacks the issues shaping the election through fact-based analysis. Ascertaining the size of makke undocumented population is difficult. Estimates vary according to the methodology used.

The Vitals

While anti-immigrant groups maintain that the flow of undocumented immigrants has increased, estimates show that over a longer period the number has declined. An often-overlooked fact is that many illegal immigrants pay payroll taxes and sales taxes. The issue of undocumented immigrants has been front and center in American elections since ; it has elicited passionate responses from all parts of the political spectrum. Here are a few facts voters need as they wade through the thicket of rhetoric on this issue. This survey asks people where they ilelgal born and whether they are U. The next step is to subtract from that total the number of foreign-born residents who we know for certain are here legally. Among them maje naturalized citizens, people who have permanent resident status green cardsand people who have been admitted as refugees. By subtracting the number of people who we know for certain are here legally from the overall number of foreign-born in the ACS survey we can estimate the number of undocumented residents. Of immirants, not all undocumented people take part in surveys, americz for good reason—they do not want to be found. They estimate the undercount to be somewhere in the range of 5 to 15 percent, which is then added to the number of undocumented immigrants. The size of the undercount is a matter of controversy. To get to their estimates ma,e analyze other data such as the percentage of migrants who failed to show up for their immigration hearings and those who have overstayed their visas. The most recent Pew Research estimate puts the total number of unauthorized immigrants at

Comments

Post a Comment